On January 16th 2020, INAA member The Accountancy welcomed the group to Glendale California for a two-day forum on financial & accounting ‘hot topics.’ The conference gave members a chance to enjoy the Californian sunshine as well as fascinating talks on a range of essential subjects.

Keep reading to get an overview of some of our favourite talks and stay up-to-date on the latest accountancy topics.

Understanding Cyber Security & Protecting Your Organisation

Louie Sadd – CEO, Datastream Technology

Louie Sadd, CEO of Datastream Technology, kicked off the forum with a fascinating look into cybersecurity.

With well-known companies like Walmart, eBay, Sony and Deloitte falling prey to cyberattacks, no company can escape the attention of cybercriminals. More than 60% of companies close within six months of experiencing a cyberattack due to the extreme impact it has on businesses.

Instead, the best line of defence is a good offence. Louie provided vital advice into how companies can protect against cybercrime and common pitfalls to avoid like malware, phishing, and password hacking.

As part of this educational talk, Louie also offered ten actionable tips that companies could take straight away to improve their defence and encourage safe online actions.

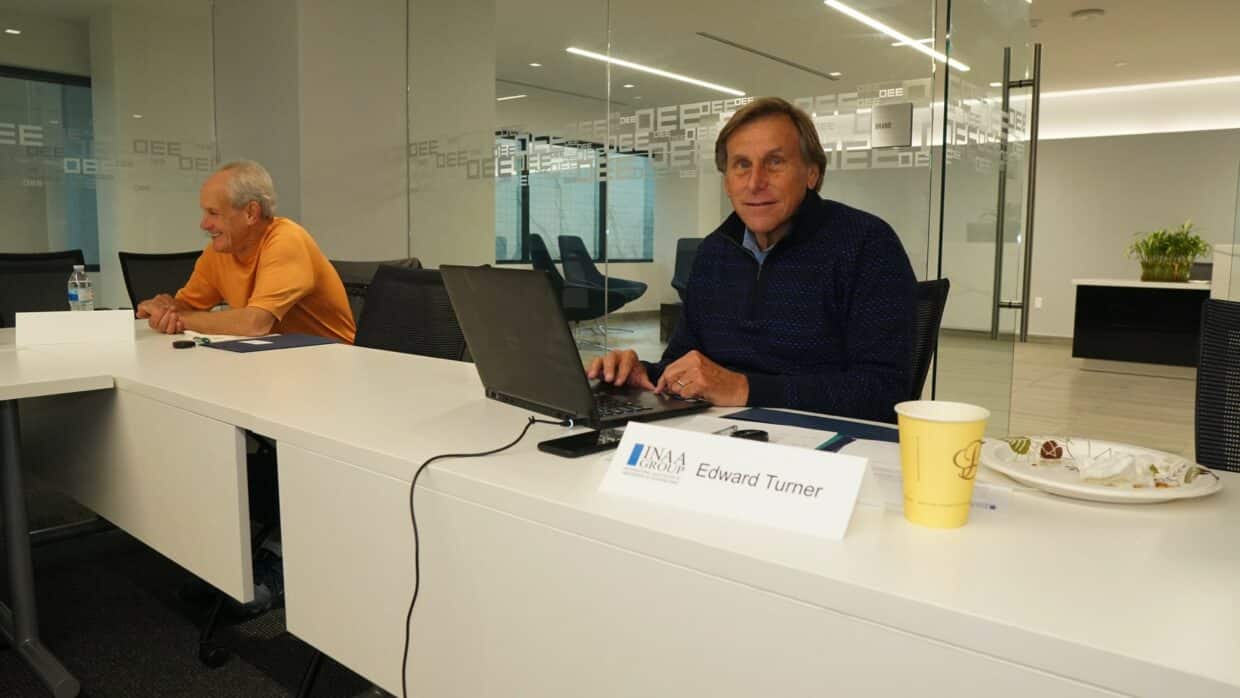

International Tax Issues & Pitfalls - IRS Hot Topics

Vic Abajian & Aksel Bagheri, Abajian Law

Discover who qualifies as a US taxpayer in the eyes of the IRS and whether you pass the ‘presence test.’ Even if you pass the substantial presence test, you may still need to pay taxes to the US.

Vic Abajian’s talk explored the different models under which you’d need to pay taxes to the IRS and how foreign persons or entities can make payments. His presentation also touched upon instances where US citizens living abroad may still need to pay taxes.

The Value of Collaborative Advice

Panel Discussion with Bridge Advisory & The Accountancy – Suzanne Lawrence Moderator

Dave Penniall, Vanessa Burnett and Alex Leu joined in a panel discussion to explore the value of collaborative advice or integrated services. They also touched upon the CPA’s role in delivering C/A & I/S as well as emerging trends and challenges within the space.

Their talk addressed questions like:

- Why should a CPA firm have an alliance with a WM firm?

- Why does an alliance make a better business model?

- How does an alliance help the client?

- And, how can collaborations create & enhance enterprise value?

After answering these questions, the panel looked at how processes can be built around the client to include their personal goals, investment plans, cash management, taxes and much more.

The conversation then moved on to discuss the industry realities like the 0 to 1% growth in CPA US individual tax return market and 40% growth in the number of retirees. These circumstances place an even greater need for collaboration.

Maximizing Global Potential

Robert Saikali, International Banking & Trade - VP & Manager, City National Bank

Robert Saikali, Vice President & Manager at City National Bank, joined the forum to discuss how companies and individuals can get the best results from their global portfolio. He kicked off his talk by exploring the distribution of wealth and how it’s changed over the last 500 years.

After giving an overview of how wealth has shifted across the globe, he persuasively argued that global wealth depends on international trade. And, as such, companies cannot afford to ignore the export business.

Exporting can offer many advantages like the potential to grow sales and profits, market expansion, access to a diversified income stream, and much more.

So, how can bankers support companies and individuals with global portfolios?

Robert then explored some of the vital tools for bankers within the sector, various trade finance solutions and how financial service providers can mitigate the risk associated with foreign exchange and interest rates.

Changing the Game

Bryan Sonderby, Certified Exit Planning Advisor

Bryan Sonderby from Crestwell took the stage to talk about how business owners can plan their exit from the company and achieve an effective transition.

During this discussion, Bryan provided a review of the social and economic market dynamics in play like the fact that more than 50% of Boomer business owners are over the age of 64. And as the generational wave gets closer, it becomes inevitable that companies will need to transition ownership.

But, traditionally selling a company hasn’t been an easy road. 70 to 80% of businesses put on the market don’t sell and even when companies remain in the family success rates are shockingly low.

Most business owners aren’t prepared for their eventual or sometimes unexpected exit. However, business owners can make this transition easier by putting a plan in place that focuses on building, harvesting and preserving wealth and focusing on the enterprise value.

Putting a proven process in place that focuses on the enterprise value and aligns the business, personal and financial goals of the owner could offer the perfect solution.

Join Our Next Event

Don’t miss your chance to hear industry insights and expand your horizons. Find an upcoming event near you on our event page. We look forward to seeing you!