Social security rates in Portugal can range up to 34.75%, but tax relief is available. Further tax relief is available for electric and hybrid cars.

Exemption and reduction of payment of Social Security contributions

Did you know that your company can benefit from exemption or reduction in the contributions paid to Social Security? This is important if the rates can range up to 34.75%.

Effectively, in Portugal, there is the possibility of optimising social security fees, taking into account the following:

-

Exemption from payment of contributions, in the contracting of:

- Very long-term unemployed

-

Reduction of the value of contributions, in the contracting of:

- Young people looking for 1st job;

- Long-term unemployed.

So, in order for you to enjoy this reduction in the value of your contributions, we share here all the information you should take into account.

To whom does it apply?

Companies that enter into permanent employment contracts with the following, can access to exemption or reduction of the payment of social security contributions:

- Young people looking for the 1st job - young people up to the age of 30, inclusive, who have never provided the activity under an open-ended employment contract;

- Long-term unemployed - unemployed who, at the date of the contract, are available for work and registered at the employment centres for 12 months or more;

-

Very long-term unemployed - are considered to be very long-term unemployed persons, those who are 45 years of age or older and have been registered at the employment centre for 25 months or more. Also included are workers who:

- Have entered into an employment contract for an indefinite period and which have ceased during the trial period;

- Attended professional internship;

- Have been included in occupational programs;

- Have entered into a fixed-term contract or have been employed for a period of less than 6 months, with a combined duration of not more than 12 months.

And that respect the following conditions of access:

- Be legally constituted and properly registered;

- Have the tax and contributory situation regularised;

- Do not delay payment of salaries;

- Have at its service, in the month of application, a total number of workers higher than the average number of workers registered in the immediately preceding 12 months.

What is the duration of the exemption and reduction periods?

The reduction of the payment of contributions applies in the following terms:

- Temporary reduction of 50% of the contributory rate of the employer's responsibility for the recruitment of young people in search of their first job, over a period of five years;

- Temporary reduction of 50% of the contributory rate of the employer's responsibility for the hiring of the long-term unemployed over a period of three years.

The total exemption from the payment of contributions applies in the following terms:

- The hiring of very long-term unemployed benefits from the temporary exemption of the employer's liability tax for a period of three years.

The exemption from payment of Social Security contributions begins:

- On the date of commencement of the employment contract;

- At the beginning of the month following the date of application, if it is submitted after the deadline;

- At the beginning of the month following the Regularisation of the situation, in the case of:

- the application has been rejected because the employer is not legally constituted and duly registered;

- not having the tax and contributory situation regularised towards Social Security and Finance;

- having delay in the payment of the compensations.

Note: The count of the exemption period is suspended if the employment contract is suspended due to proven situations of incapacity or impossibility to work, by the worker.

In what situation can the benefit stop?

The benefit on Social Security contributions ceases when:

- the concession period ends;

- the conditions of access are no longer verified;

- the non-delivery, within the legal term, of the declarations of remuneration or failure to include any workers in said statements, is verified;

- the employment contract terminates.

How to access this incentive to hiring?

Companies may request access to this hiring incentive through the Direct Social Security service.

This application, which is accompanied by a copy of the employment contract and a copy of a certificate of exemption from debt to the Tax Authority, must be submitted no later than 10 days after the date of commencement of the employment contract.

The social security services may request from the employers or concerned workers the documentary evidence necessary to prove their situations.

If you need any help, feel free to contact us.

Tax Benefits in Portugal – Electric and plug-in hybrid vehicles

In Portugal, companies can benefit from some tax benefits from the acquisition of electric and plug-in hybrid vehicles, which allow them to obtain gains compared to the purchase of conventional fuel vehicles.

These advantages come with the introduction of the possibility of VAT deduction on the purchase of vehicles and their expenses, with the reduction or even with the elimination of autonomous taxation, and with an amplification of the depreciation and amortization value fiscally accepted.

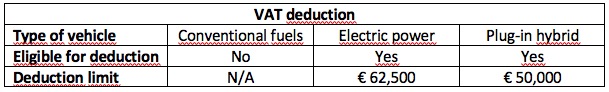

- VAT deduction possibility

The VAT value of the purchase of electric or plug-in hybrid vehicles is deductible under certain limits.

These limits are verified at the level of the purchase price of the vehicle, corresponding to € 62,500 for vehicles powered by electric power and € 50,000 for hybrid plug-in vehicles. Therefore, we have been able to equate the tax treatment of light passenger cars with light goods vehicles.

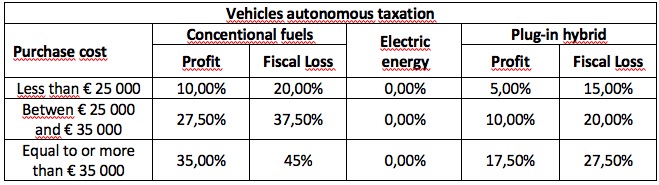

- Autonomous taxation - remission or revocation

The purchase of vehicles powered by conventional fuels and all the expenses of procedures are subject to autonomous taxation according to the purchase price of the vehicle, and with the result of the company.

Regarding the acquisition of vehicles powered by electric energy, as well as the respective expenses, they aren’t subject to any autonomous taxation.

In the case of hybrid plug-in vehicles, taxable persons are found to be exempt from autonomous tax rates when compared to the rates in force for traditional fuel vehicles.

Let's see:

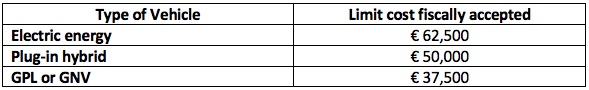

- Depreciations fiscally accepted

When we look at the depreciation of vehicles, we must pay special attention to the limits defined for the fiscally accepted values, that is, for the values of acquisition of light passenger cars or mixed vehicles that are accepted as expenses.

These limits differ according to the type of vehicles, and there is an additional limitation according to the year of purchase of the vehicle.

With respect to fossil fuel vehicles, the acquisition value up to a limit of € 25,000 is accepted. For vehicles powered exclusively by electric energy, the current tax limit is € 62,500. If we are facing plug-in hybrid vehicles, the acquisition cost is up to € 50,000. Under the same conditions, for vehicles powered by LPG or NGV, the limit is € 37,500.

In addition to these benefits, with the acquisition of vehicles powered by electricity, there are still other benefits.

Pedro Fernandes

UWU (“Up With Us!”)

suporte@uwu.pt