While China has been a hot topic across the globe in recent months, understanding the reality of the situation can be difficult amidst the pandemonium of the ongoing pandemic. The outbreak of COVID-19 at the start of 2020 is set to end China’s extraordinary forty-four year run of consistent economic growth, with the first three months of the year showing a 6.8% decline.

To get a clearer picture of how China is coping with the challenges of COVID-19, we reached out to the Founding Partner at China Integrated, Nicolas Musy, to get his personal insights and hard facts about China’s economic growth in response to the virus.

As a valued member of the INAA community, China Integrated provide dedicated solutions to help international companies develop successful businesses in China. Its team of twenty-five in-house entrepreneurs, strategists, managers, and service professionals offer highly-adaptable solutions in the fields of business research, legal environment, recruitment, tax & finance, IT networks/ERP & media relations.

Join us as we take a closer look at Nicolas’ insights and dig a layer deeper to reveal some much-needed positivity in these difficult times.

While 2020 is set to be a particularly difficult year for economies across the world, Nicolas is hopeful that China’s proactive response to COVID-19 will balance the sudden decline at the start of the year and pave the way for a brighter 2021.

Incredibly, a recent IMF forecast predicts the Chinese economy will experience positive growth of 8.2% in 2021. So, how does China plan to get back on its feet and support the Chinese people through the toughest year in recent history?

Nicolas explains how Xi Jinping’s government has responded with numerous support policies to soften the economic blow of recent events, encourage consumer spending, and help companies regain financial stability in the second half of 2020.

Let’s take a look at the key dimensions of China’s extensive recovery plan.

Reduced Interest Rates on State-Funded Business Loans

China’s state banks have provided new loans to large companies with reduced interest rates. While the lowest lending rates to enterprises remains relatively high in comparison to many other nations at 4.35%, the government hopes these reduced rates will give Chinese companies the leg-up they need to regain strength.

Exemption From Social Charges for SME Employees

Nicolas explains how the unexpected decision made by China’s Premier of the State Council, Li Keqiang, to reduce corporate social insurance premiums for SMEs could ease the financial pressures of employing staff during the pandemic.

Social insurance premiums include expenses like pension payouts, workplace injury insurances, and unemployment insurance contributions. Experts predict exemption from such fees could save businesses up to 15% in compensation and benefits payouts over the second half of 2020.

Launching Infrastructure & Construction Projects

One of the biggest factors behind China's economic growth in ‘normal’ times is its steadfast commitment to investing in new infrastructure across its twenty-three provinces.

While many nations have faced COVID-19 by hunkering down and weathering the storm, Nicolas describes China’s proactive approach of using the construction industry as a tool to reignite economic activity and regain momentum.

With China betting $600 billion on infrastructural growth, cement sales increasing by 8%, steel sales by 6% and heavy-duty vehicle sales shooting up by over 60% in May, the second half of 2020 presents exciting opportunities for the Chinese construction industry.

Nicolas also adds that industrial production was up by 4.4% in May compared to the previous year and the Purchasing Managers Index (PMI) for the Chinese industry and services indicate overall economic expansion in both May and June.

As the Chinese people remain cautious not to engage in social activities that could increase the risk of viral transmission, consumption levels in May remain 2.8% lower than the previous year.

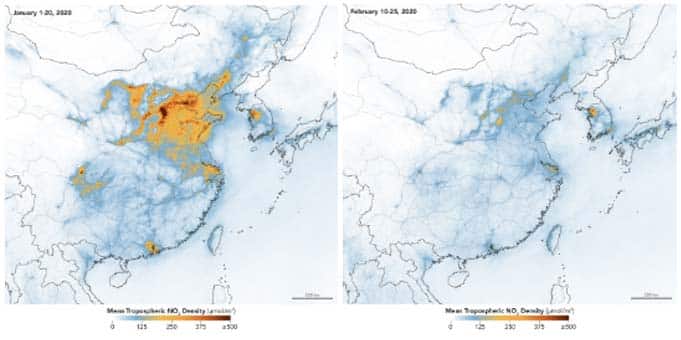

Nicolas illustrates this dip in social activity by comparing pollution charts that record the Nitrogen Dioxide levels across China between 1st January and 25th February 2020.

Source: https://earthobservatory.nasa.gov/images/146362/airborne-nitrogen-dioxide-plummets-over-china

That said, China’s citizens have the most positive outlook on their personal financial position in comparison to other major economies. A global study by Mckinsey on consumer sentiment during the coronavirus crisis compares the outlook of financial decision-makers in reference to both their domestic economy and their individual financial position.

While the likes of South Africa, Italy, and Spain report extremely low confidence in their personal finances, 60% of those surveyed in China responded positively.

Nicolas describes how this confidence in consumers will play a vital role in the so-called ‘revenge consumption’ — a predicted surge in spending in the latter half of 2020 as consumers rediscover their appetite for consumption.

Improved Control of Isolated Breakouts

While China has been criticized in the global media for its handling of COVID-19, Nicolas is impressed by the government’s recent efforts to clamp down on isolated outbreaks in both Wuhan and Beijing since May 2020.

After a cluster of Wuhan citizens tested positive for COVID-19 at the beginning of May, the Chinese government successfully tested all ten million inhabitants in just a twenty-day window.

Similarly, Nicolas describes the efficiency with which the government has carried out rapid screening measures across 2.3 million Beijing inhabitants in the second half of June to curb the risk of infection in specific neighbourhoods. Strict isolation measures were successfully implemented for the 227 individuals who tested positive.

The Start of a Long Road to Recovery for China

As uncertainty prevails and China continues to battle forward, Nicolas describes the impressive containment of the recent Beijing outbreak as a positive sign that the country has developed the necessary social tools to control the pandemic without major economic impact.

Stay in the Loop With INAA

INAA is an International Association of Independent Accounting firms, established over 25 years ago to facilitate cross-border business. We connect accounting firms who are committed to delivering quality professional services and sharing their expert knowledge to champion progress across the accounting sector.

Join today to build powerful business relationships.