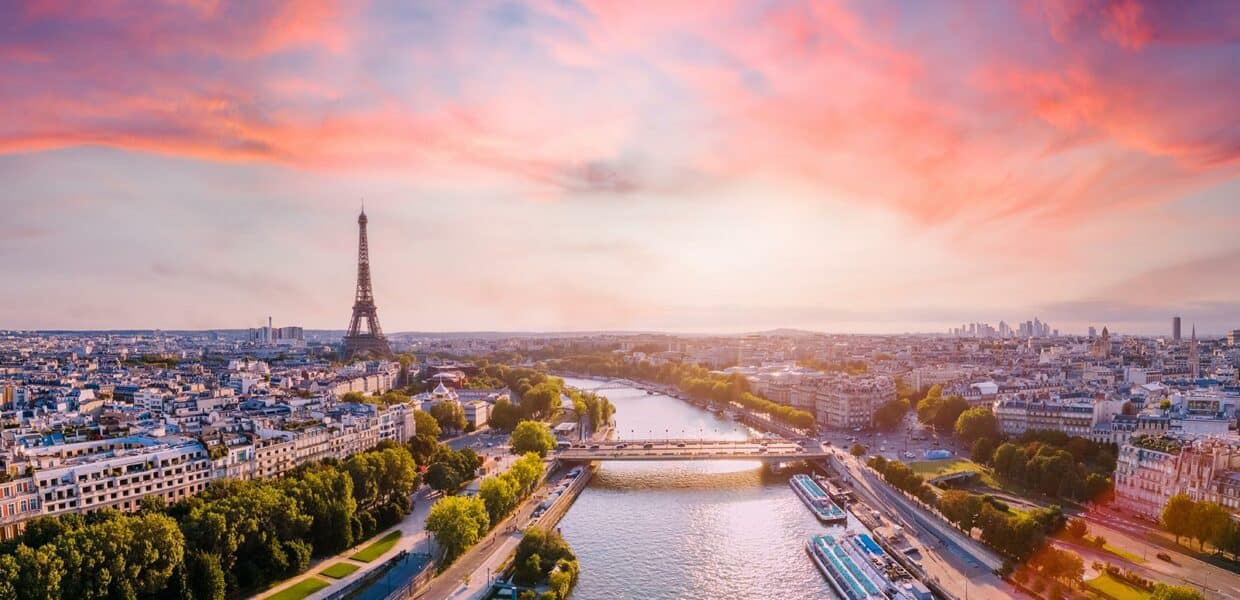

France

Country Knowledge

Our local member provided the following preliminary information about doing business in this country.

Please contact the firm for more information and obtain professional advice in each country concerned.

Our local member will be happy to help you proceed with your business!

The information provided on this website is intended for general informational purposes only and should not be construed as professional advice. While our members make every effort to ensure the accuracy and reliability of the information presented, we cannot guarantee its completeness, timeliness, or suitability for any particular purpose.

We strongly recommend that you seek professional advice from a qualified expert in the relevant field before making any decisions or taking any actions based on the information provided on this website. Your reliance on any information presented on this website is at your own risk.

Please note that the information on this website is subject to change without notice, and we assume no responsibility or liability for any errors or omissions in the content. By accessing and using this website, you agree to release us from any and all claims, liabilities, and damages arising from your use of the information provided herein.