The China Integrated Analysis

The China Integrated Analysis

30 december 2022

2022 was a year of extraordinary events, to say the least. It would not be surprising if historians of the future see it as a landmark, marking an inflection point in our modern world history.

Europe is the stage of a land war, reminding us of World Wars I and II, while an overwhelming majority of Europeans thought that such an event was not possible anymore. After all, the United Nations were established and the Geneva Conventions (codifying the laws of war) were signed with the exact purpose to prevent such catastrophes and humanitarian disasters.

China stuck to its zero-covid policy to deal with the vastly more contagious Omicron covid variant while at the same time strongly emphasizing its one China policy on Taiwan and establishing a “no-limits” partnership with Russia. (On 25 December 2022, China’s Foreign Minister announced that China will deepen its “rock-solid” strategic partnership with Russia in 2023.) And when the country exited its zero-covid policy, it did so without warning and with no apparent plan to mitigate the unavoidable tsunami of infections.

Sanctions on Russia, Black Sea blockades and supply chain issues due to the worldwide pandemic and China’s lockdowns have ignited inflation in Europe and around the world.

In the last three decades, companies that invested in China have been used to a very high level of economic predictability. Growth targets were generally met and 5-year plans were generally fulfilled. As a result, the uncertainty that 2022 has brought to international companies doing business with China is all the more striking and a key new factor.

What happens next in China, the workshop of the world and the world’s second economic powerhouse with a large army, will be a key to chart where the inflection started in 2022 leads to.

As a natural consequence, understanding what are China’s possible trajectories in the years to come, economically and geopolitically, becomes crucial for all international businesses.

Zero-Covid No-More – more disruptions or recovery?

The abandonment of the zero-covid policy was abrupt. Within about a week, all restrictions were lifted. Cities were required by the central government not to test passengers arriving from other domestic locations. No social distancing or mask mandates have been implemented. As a result, the current outbreak is brutal. Testing is not encouraged and neither is the reporting of positive cases. In addition, China has announced that only deaths of patients with covid due to respiratory infections will be attributed to covid. As a result, the figures published by state organs do not represent what is currently happening (as acknowledged by Chinese officials themselves).

It is however possible to evaluate what is unfolding based on the data of the Shanghai outbreak in the Spring of 2022, which was ended through two months of full lockdown of the city (in April and May), as well as by analyzing the Omicron wave in Hong-Kong.

Shanghai recorded about 600 deaths (all death of patients infected with covid, not from respiratory illness only) for roughly 600’000 positive cases identified. Considering that we had to take PCR tests multiple times every week during this outbreak, the number of recorded cases is probably very close to the actual number of infected persons. On this basis one out of one thousand persons infected in Shanghai (0.1%) passed away. If this is extrapolated to the whole country, the potential is for up to 1.4 million fatalities.

But since Omicron infections causes severe illness and death almost only among old people, another way to evaluate the impact of the current outbreak is to base it on the proportion of older people who died in Hong-Kong, according to their age group. Indeed, the vaccination status of the Hong-Kong population is broadly similar to the one in China (though around half the Hong-Kong population received the Pfizer vaccine) and Hong-Kong published detailed statistics during 2022.

Following this approach, among the Hong-Kong elders over 80 years old, 7.5% of those infected died; among the 70 to 80 age this rate went down to 1.15%. However, depending on age groups, between 25% and 30% only of the older population have been reported as infected[1]. (More have most probably been infected, had a mild illness and did not test or did not report their infection.) By compounding these proportions and applying them to the Mainland, the estimated fatalities reach around 1.1 million. (This may happen through multiple waves and 9 to 12 months if Hong-Kong is a representative case.)

Hospitalizations will naturally be a multiple of these numbers (between 4 and 10 times depending on elder age groups based on Hong-Kong data). Though these figures are not large when compared to China’s huge population, they are large enough to create a public health crisis, considering that China’s health care system is running at near full capacity in normal times.

Based on international news videos and reports, the crisis has begun. It will peak and subside in different locations at different times so that it is difficult to give it an end. (An unverified government memo reported that between 1st and 20th December 17.5% of China’s population and 50% of Beijing’s had been infected and that the capital city infections peak had already been reached.[2])

It is probably reasonable to expect that the first (and probably biggest) wave will be exhausted in the coming 3 months, particularly since most migrant workers will return from large cities to their hometowns for Chinese New Year Day (on 22nd January in 2023), speeding up propagation of the infection to many rural areas.

After that, much will depend if new variants or subvariants emerge with the ability to evade the immunity acquired by the population during the first wave. Considering the size of China’s population and the speed of the outbreak, the potential for mutations is important and it would not be prudent to discount this eventuality. As a result more waves should be expected, as it happened in the rest of the world, and particularly if China does not develop or import the mRNA technology that allows fast new vaccines development.

Economically, this health care crisis is having an immediate impact on consumer consumption. By our own experience, shopping malls and restaurants are deserted. In our analysis of June 2020 we published a photo showing long lines of customers waiting to buy luxury goods in Shanghai’s IFC Mall. The same photo taken at the end of this December month would show a dozen luxury shops without a single customer. As a result, 2022 as a whole will show negative growth in retail sales. A key reason for this spontaneous social distancing is certainly the fear of infecting elders, since many families live with their parents and grand-parents.

This low consumption situation will most likely continue until the current wave has passed.

On the manufacturing side, production has held up. 2022 will account for an increase in industrial production. And though production will be affected by infected workers staying at home in the next months, most blue collar employees are relatively young and return to work within one or two weeks. As a whole, disruptions to production should be less than those generated by the zero-covid restrictions and lockdowns. The American Chamber of Commerce December survey reported that only 17% of respondents expected supply chain disruptions. As a result, we would expect much smaller supply chain disruptions from China in 2023.

All in all, we should therefore expect a recovery of China’s economy in 2023, starting from the second or third quarter, depending on new covid waves. It is particularly likely because Chinese households have accumulated record savings, in a similar way to what happened in Europe and the USA while covid restrictions were in place. Many economists expect a GDP growth of around 5% or slightly more, which should help exporters in the rest of the world and the global economy.

Additionally, after 3 years of staying in China, Chinese are very eager to travel again, so that the opening will bring back Chinese tourists to the world almost immediately, if flights restrictions are lifted as well.

The end of zero-covid is without a doubt welcome news for China and international businesses. One question remains however: why was the abandonment of zero-covid so abrupt?

China’s economy is losing two of its traditional growth engines

The key reason for China’s covid policy U-turn is probably the status of its economy, rather than the much highlighted protests that erupted at the end of November.

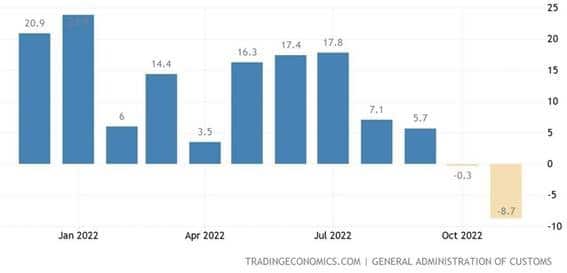

Indeed, exports and real estate, two key growth drivers of the past decades are unlikely to contribute to further growth, and therefore employment, in the future.

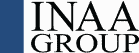

China’s real estate market latent crisis has been much talked about, but its underlying reasons much less so. It is however quite simple: as already mentioned in our previous analysis, 91% of Chinese households already own an apartment or a house (while only 45% of the Swiss do[3]).

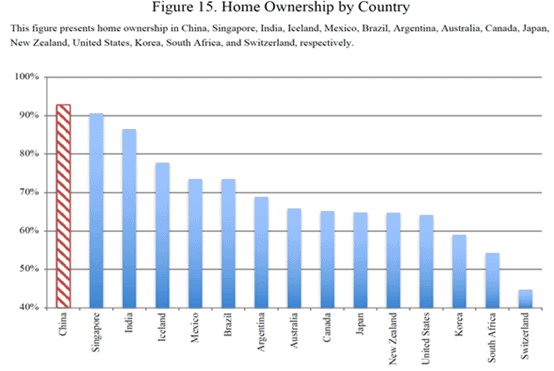

And since China’s working age population is peaking, there is simply not much growth potential in the real estate market.

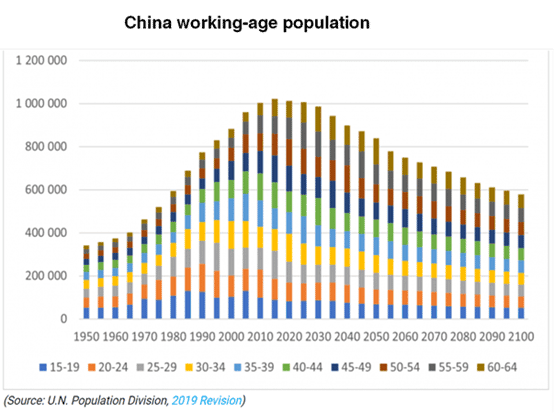

Another of China’s key traditional growth engine and the most important one over the past decades, domestic consumption (measured by retail sales), has been completely stalled by the zero-covid policy under Omicron. Mainly for this reason and for the first time in 30 years, China will grow less (around 3.3%) than the developing economies of Asia (estimate of 4.3 %) in 2022[4].

An important part of the 2022 increase in GDP will come from exports, which have been strong, both in 2021 and in the first 3 quarters of 2022.

Gross capital formation, another important component of China’s growth mentioned on the chart above, includes investments of government, state-owned, private companies and private citizens. It has been a strong contributor to China’s growth, but, since 2009, it comes at the expense of ever growing level of debt as a percentage of GDP. And since profitable, big infrastructure projects are less and less after a decade of heavy investments, the government will eventually be limited in its use of this other traditional growth driver.

Coming back to exports, in a remarkable video speech to 100,000 government officials at the end of May 2022, China’s outgoing Prime Minister (Li Keqiang) stated that: “The 8.1 per cent growth of China’s economy last year [2021] was largely driven by foreign trade” and “we must recognize that 70 per cent of our manufacturing relies on imported parts, and that foreign trade generates direct and indirect jobs for 180 million people“[5].

However, from October 2022, exports turned negative and plunged in November to – 8.7%.

While a big part of this export decline is most certainly due to lower demand from the rest of the world, it is important to keep in mind that 36% of China’s exports are generated by foreign invested companies[6]. As a result, the zero-covid policy had a triple negative economic effect: costs were huge (some have estimated it at 3.1% of GDP, while the official military budget is 1.7%[7].), the policy prevented consumption and foreign companies have been actively looking to replace their China purchases with alternative sources due to supply chain disruptions, thereby further endangering exports.

Besides, looking at the speed with which the current wave is peaking, the partial lockdowns that have been implemented after the Shanghai full lockdown were probably not successful enough to fully contain the Omicron spread. (The WHO implied it on 15 December: China‘s Covid spike not due to lifting of restrictions, WHO director says.) Under the circumstances, maintaining zero-covid would have amounted to more major cities full lockdowns with no end in sight, resulting in inevitable and dramatic economic decline.

And then, what’s next ?

Now that zero-covid has been abandoned, China’s government will take full advantage of its re-opening, both in terms of domestic consumption and international trade. Chinese delegations are already traveling abroad. The Executive Vice-Mayor of Guangzhou (also called Canton, a major city of China) has been visiting Zurich and Neuchatel on 22nd December to promote foreign trade and investment with their city. We can expect a large number of China’s cities, provinces and organization traveling abroad to try and restore relations.

In addition, by promoting internally a fast growing domestic consumption, China expects to create a “gravitational field of high-end international resources” [8], making China an overwhelmingly attractive destination for international companies’ exports and investments.

At the same time, as announced at the 20th Communist Party Congress, the government intends to develop a new growth engine for China: innovation. It is intended to have the dual purpose of increasing the country’s technology self-reliance as well as its productivity, therefore generating more value per working person. Since population (and employment) is expect to peak in 2023 (if it did not already in 2022), improving productivity is indeed the only avenue for increasing China’s population income and therefore its GDP.

Yet, geopolitical considerations have lead the USA to impose ever stronger restrictions on the transfer to and use by China of US technology. It is not clear yet how much this will impact China’s drive towards indigenous innovation. As well, it is still unclear how the deepening of China’s partnership with Russia will impact Europe’s cooperation with China, though the first signs are that Europe may generally align with the United States on technology restrictions[9].

China definitely has the potential, talent, infrastructure and resources to develop its local market through innovation. Yet, economists will generally agree that this potential will be fulfilled only if the private sector is strongly engaged. The central economic work conference (organized by the State Council and the Central Committee of Communist Party on 15 and 16 December) recognized it. However, skepticism among Chinese entrepreneurs still remains[10].

In the coming months, we will provide additional information and economic as well as geopolitical analysis on these key topics, since they will provide essential pointers to China’s economic future for business decision makers.

China’s Tiger year has proved to be very difficult, though many companies we know managed to make good results out of it.

We hope that the above is helpful to your understanding of China’s development and, for now, we empathize with China’s difficult months ahead and look forward to the prospect of a much brighter year 2023!

Your China Integrated team

Want to know more about China Integrated?

China Integrated is designed to facilitate the long-term, superior success of its clients in China.

With 20 years experience and comprehensive in-house expertise in research, legal, recruitment, tax, finance, IT/ERP & public relations, China Integrated is specialized in establishing or acquiring successful businesses and managing the back offices of its clients.

China Integrated has offices in Shanghai, Beijing, Hong Kong and Mongolia.

Engineering your Success !

Browse their profile on the INAA website Visit their website

References

[1] Source: 2019冠狀病毒病第5波數據 Statistics on 5th Wave of COVID-19 (coronavirus.gov.hk)

[2.1] Source: Peak China Housing_2020_08_12 (harvard.edu)

[3] Source: ADB: Asia’s developing economies are set to grow faster than China’s (cnbc.com)

[4] Source: China: foreign companies share in import and export 1986-2020 | Statista

[5] Source: Shanghai lockdown tests limits of China‘s dynamic zero Covid-19 policy. South China Morning Post